The Top 12 Best Free AI Video Maker Tools for Brands in 2025

The Top 12 Best Free AI Video Maker Tools for Brands in 2025

Calculating your Cost Per Acquisition (CPA) is simpler than you might think: just divide the total cost of a marketing campaign by the number of new customers it brought in. Getting a handle on this one formula is genuinely the key to seeing a campaign's true financial performance and making much smarter calls on where your budget goes next.

Table of Contents

Why This Simple Number Is a Big Deal

Cost Per Acquisition isn't just another marketing acronym to memorize; it's the financial pulse of your entire advertising strategy. It tells you, in plain dollars and cents, exactly how much you’re spending to bring each new customer into the fold.

Without that clarity, you're basically marketing with a blindfold on, just hoping your ad spend somehow turns into actual growth.

Knowing your CPA is a game-changer. It empowers you to:

- Justify Your Budget: Show stakeholders clear, data-backed evidence of your marketing's return on investment. No more vague promises.

- Spot the Winners: Immediately see which channels, influencers, and strategies are the most efficient at acquiring customers.

- Optimize Your Ad Spend: Feel confident pulling money from campaigns that aren't delivering and pouring it into the ones that are.

- Build for the Long Term: Make sure the cost to get a customer is well below their lifetime value (LTV), which is the bedrock of sustainable growth.

Unpacking the Core Formula

At its heart, the calculation couldn't be more direct. It all comes down to two numbers: how much you spent and how many new customers you got.

Total Cost ÷ New Customers Acquired = CPA

So, if you put $10,000 into an influencer campaign and it brings in 500 brand-new customers, your CPA is $20. It’s that easy.

To really get a feel for the two main variables in this formula, here’s a quick breakdown.

Breaking Down the CPA Formula

| Component | What It Includes | Example |

|---|---|---|

| Total Cost | All expenses tied to the campaign. This includes influencer fees, product seeding costs, software, and ad spend. | Influencer payment of $5,000 + $500 in free product. |

| New Customers Acquired | The total number of first-time buyers directly attributable to the campaign, tracked via codes or unique links. | 250 new customers who used the influencer's discount code. |

This table should help you quickly identify what numbers you need to pull to get an accurate CPA.

Key Takeaway: Chasing the lowest possible CPA isn't always the right move. A "good" CPA is simply one that's significantly lower than your Customer Lifetime Value. That's how you ensure every new acquisition is profitable in the long run.

Understanding CPA is fundamental to mastering performance-based advertising, where every dollar you spend is tied to a measurable result. This metric is your most direct link between spending money and making money, turning abstract campaign goals into tangible business outcomes.

Uncovering All Your Campaign Costs

To get your cost per acquisition right, you have to put on your detective hat and audit every single expense tied to your campaign. Your final CPA number is only as good as the "cost" figure you plug in, and it's surprisingly easy to miss major expenses hiding in plain sight.

Most marketers nail the obvious, direct costs. These are the straightforward line items you'd find on an invoice. For an influencer marketing campaign, this means the influencer's fee and any budget you set aside for boosting their posts with paid ads.

But a truly accurate calculation goes much deeper, digging into the indirect and often-forgotten costs that made the campaign possible. If you skip these hidden expenses, you'll end up with an artificially low CPA, which can lead to some really poor budget decisions down the road.

Finding the Hidden Expenses

Think about every single resource that went into making the campaign happen. Your team's time isn't free, and neither are the tools you use to run your marketing stack.

Start building out a complete cost list by looking for these things:

- Content Creation: Did you hire a photographer for product shots or a videographer for B-roll footage the influencer could use? Those costs absolutely belong in your total.

- Software Subscriptions: What tools were involved? Make sure to include a prorated portion of your monthly subscription for your analytics platform, social media scheduler, or any project management software that was used.

- Team Salaries: This one's huge. Calculate the hourly rate for the employees who worked on the campaign (like the influencer manager or social media coordinator) and multiply it by the hours they spent.

- Agency Fees: If you're working with an agency, a percentage of their monthly retainer needs to be allocated to the total campaign cost.

Let’s break it down with a real-world scenario. Imagine a product launch with an influencer. The direct cost is their $5,000 fee. Simple enough. But your marketing manager, who earns $80,000 a year, spent 10 hours managing the partnership (that's about $385 of their salary). You also used a $100/month analytics tool specifically for this project. Suddenly, your true cost isn't $5,000; it's $5,485. This is the only way to get a realistic CPA.

Nailing Down Your New Customer Count

Once you’ve got your campaign costs buttoned up, the next big piece of the puzzle is figuring out exactly how many new customers you actually brought in. This isn't just a vanity metric; if your acquisition number is off, your entire CPA calculation goes sideways. You could end up thinking a great campaign is a dud, or worse, pouring money into one that's secretly bleeding you dry.

Good tracking is the only way to get a number you can actually trust. The best methods are usually the simplest ones because they draw a straight, undeniable line from an influencer's post to a customer's purchase.

- Unique Discount Codes: This is one of the cleanest methods out there. Give each influencer their own code (like SOPHIE15). When a customer uses it at checkout, you know precisely where that sale came from. No guesswork involved.

- UTM Parameters: For any link you give an influencer, tag it with UTMs. These little snippets of code feed data directly into tools like Google Analytics, showing you exactly which post or story drove the traffic and, ultimately, the conversion. It’s a must-do for any digital campaign.

Which Attribution Model Makes Sense?

Attribution is all about giving credit where credit is due. Think about it: a customer might see an influencer's post on Monday, click a Facebook ad on Wednesday, and then finally search your brand on Google and buy on Friday. Who gets the credit for that sale?

A last-touch attribution model gives 100% of the credit to the final step—the Google search in this case. It's simple, but it completely ignores the hard work the influencer and the Facebook ad did to get the customer interested in the first place. For most e-commerce brands, a first-touch or linear model often paints a much more realistic picture of the entire customer journey.

This is the kind of dashboard view that helps you see where conversions are really coming from.

By digging into these source reports, you can separate the channels that just drive clicks from the ones that actually make you money.

And if you're an Amazon seller, getting a handle on this is non-negotiable. Diving into understanding Amazon Attribution is a critical step to accurately connect your marketing spend to actual sales on the platform.

My Two Cents: Don't let yourself get stuck in "attribution paralysis." It's easy to overcomplicate things. Just start with a basic model like last-touch and get more sophisticated as you collect more data. The most important thing is consistency—use the same model for all your campaigns so you're always comparing apples to apples.

A Real-World CPA Calculation Walkthrough

Let's put the theory aside for a moment and walk through how this actually plays out in a real campaign. Seeing the numbers come together is the best way to get a feel for how powerful this metric is.

Imagine your e-commerce brand just wrapped up an influencer campaign with a total budget of $7,000. This wasn't just a one-time payment to a creator; that total investment was spread across a few different areas to make sure the campaign had the best chance of success.

Here’s how that $7,000 budget breaks down:

- Influencer Fees: The biggest piece of the pie at $5,000.

- Boosted Posts: An extra $1,500 was put into paid ads to amplify the influencer's content beyond their organic reach.

- Content Assets: We set aside $500 for creating some extra graphics and short video clips to support the campaign.

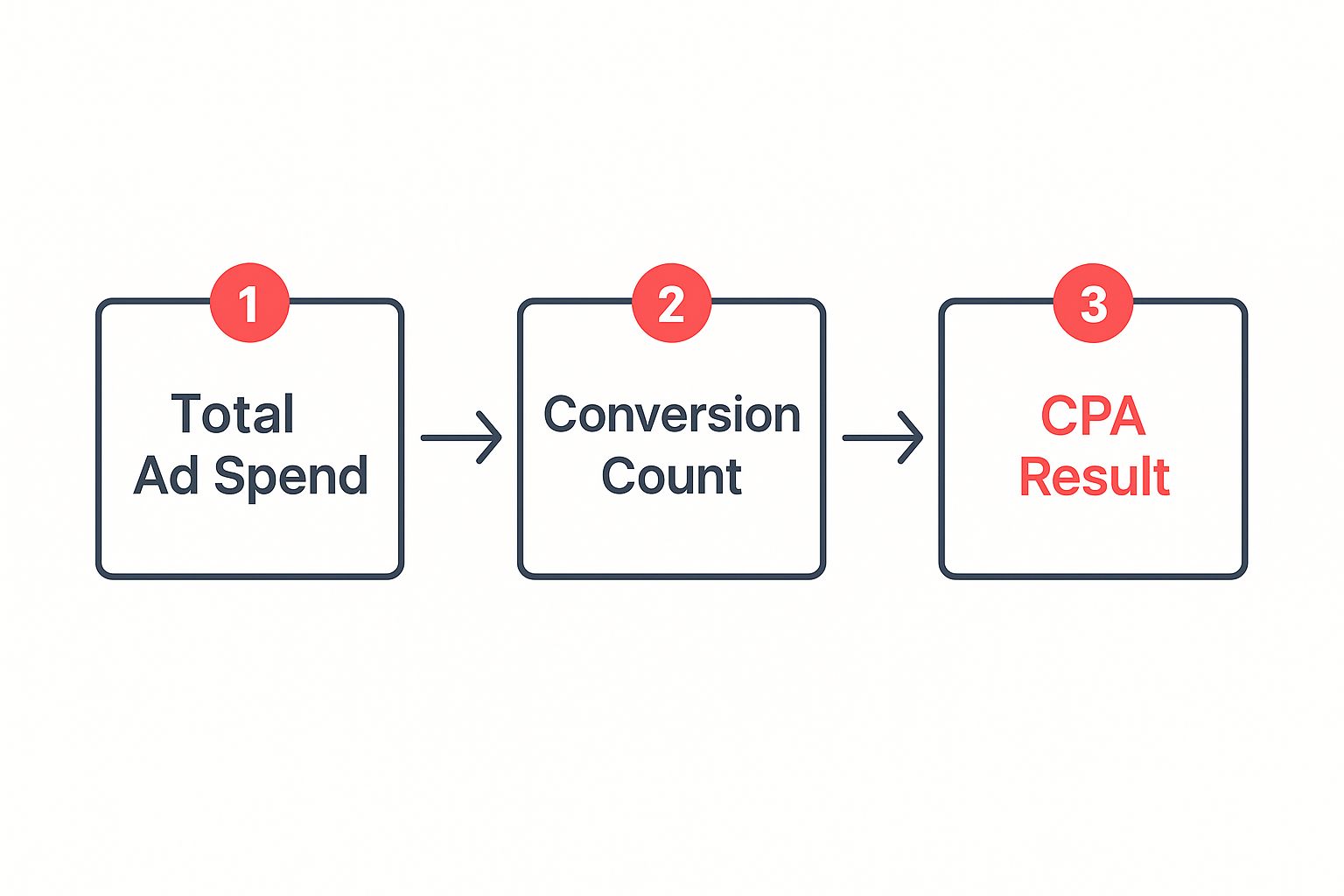

This simple flowchart shows you exactly how to take those costs and get to your final CPA.

As you can see, it really boils down to your total spend divided by your total conversions. Simple as that.

Performing the Calculation

So, how did the campaign do? By tracking a unique discount code we gave to the influencer, we can see the campaign brought in 250 brand-new customers. Now that we have our total cost and our conversion count, the math is a piece of cake.

$7,000 (Total Campaign Cost) / 250 (New Customers) = $28 CPA

What this tells us is that we spent exactly $28 to acquire each new customer from this specific influencer campaign. But this is where the real work begins, because a number by itself doesn't tell you much.

Is a $28 CPA good? That's the million-dollar question. If you're selling a $20 t-shirt, you're losing money on every single sale. But if your product is a $150 pair of premium headphones, a $28 CPA looks fantastic.

The true power of CPA comes from comparing it to your product's price and, even more importantly, your average Customer Lifetime Value (LTV). When your LTV is significantly higher than your CPA, you've found a profitable and sustainable way to grow your business. This one calculation turns a simple marketing number into a critical strategic insight.

Benchmarking Your CPA Against Industry Averages

Once you’ve nailed down how to calculate cost per acquisition, the next big question is always, “So… is my CPA any good?”

Honestly, there’s no simple answer. A “good” CPA is completely relative. It’s a number that shifts dramatically from one industry to the next, making direct comparisons without context a recipe for some seriously flawed decisions.

Think about it this way: a SaaS company with a high customer lifetime value can comfortably afford a much higher CPA than an ecommerce brand selling low-cost consumer goods. In the same way, a B2B service firm with a six-month sales cycle will have a cost structure that looks nothing like a mobile app aiming for quick, low-cost downloads.

Why Industry Differences Matter So Much

Understanding these benchmarks is key to setting realistic goals and accurately judging how your campaigns are really doing. The massive cost variations you see are driven by fundamental differences in business models.

Here are the big ones I see all the time:

- Customer Lifetime Value (LTV): Businesses with high LTV, like subscription services, can justify a higher initial acquisition cost because they know they'll make it back over time.

- Sales Cycle Length: A longer sales cycle, which is super common in B2B, involves way more touchpoints and resources. This naturally inflates the CPA.

- Market Saturation: Trying to make noise in a crowded market? You'll likely need more aggressive ad spending to stand out, pushing acquisition costs up for everyone.

- Average Order Value (AOV): Brands with a higher AOV can absorb a larger CPA per transaction and still walk away profitable.

A "good" CPA isn't a universal number pulled from a report; it's a strategic figure that is significantly lower than your own Customer Lifetime Value. Profitability is the ultimate benchmark.

This context is everything. Industry data shows just how wide these gaps can be. For example, recent figures show an eCommerce SaaS might see a Customer Acquisition Cost (CAC) as low as $274, while a fintech company could face costs as high as $1,450. That massive jump is often due to things like regulatory hurdles and the extra effort needed to build trust. You can discover more insights about these industry benchmarks and what drives them.

To give you a clearer picture, here’s a quick look at how different industries stack up.

Average Customer Acquisition Cost (CAC) by Industry

This table offers a snapshot of typical acquisition costs across various sectors. Use it to get a feel for where you might stand, but remember that these are just averages—your own numbers will be unique to your business.

| Industry | Average CAC | Key Influencing Factors |

|---|---|---|

| Retail | $10 | High competition, low AOV, relies on repeat purchases. |

| Consumer Goods | $22 | Brand loyalty is key, significant ad spend needed for visibility. |

| Travel | $7 | Highly seasonal, price-sensitive customers, competitive online space. |

| Manufacturing | $100 | Long B2B sales cycles, relationship-based selling, high LTV. |

| Technology (Hardware) | $182 | High product value, complex purchase decisions, long R&D cycles. |

| Financial Services | $175 | High LTV, strict regulations, significant trust-building required. |

| SaaS | $395 | Subscription models, focus on LTV, high churn potential. |

Seeing these numbers side-by-side really highlights why you can't just compare your CPA to a company in a completely different field.

By analyzing averages within your specific sector, you move beyond simply calculating your CPA to strategically evaluating it. This is how you figure out if you're outperforming the competition or if there's a golden opportunity to optimize your marketing spend for better efficiency and growth.

Actionable Strategies to Lower Your CPA

Knowing how to calculate your cost per acquisition is step one; making that number smaller is how you win the game. With acquisition costs always seeming to creep up, just tracking your CPA isn't enough—you need a solid plan to actively bring it down. If you're looking for practical advice, there are many proven strategies to lower your customer acquisition cost.

The most direct approach? Get laser-focused on your audience targeting. Stop wasting money on impressions that never convert by getting hyper-specific with your ad platform's demographic, interest, and behavioral filters. A smaller, more relevant audience almost always crushes a broad, scattershot approach when it comes to CPA.

Boost Your Conversion Rate

Another powerful lever you can pull is improving your landing page conversion rate. You can have the most dialed-in ad campaign in the world, but if the destination page is confusing, slow, or just plain clunky, you’re just lighting money on fire.

Here are a few quick wins to focus on:

- A/B Test Your Headlines: Try out different value propositions and see what actually resonates with your audience. You'd be surprised what a small tweak can do.

- Simplify Your Forms: Get rid of any non-essential fields. Every extra box you ask someone to fill out is another reason for them to bounce.

- Improve Page Speed: This is a big one. A one-second delay in page load time can tank conversions by a whopping 7%.

A higher Customer Lifetime Value (LTV) is your secret weapon. When you know a customer will spend more with you over time, you can afford a higher initial CPA and still remain incredibly profitable. Focus on retention just as much as acquisition.

Let's be real, the cost to acquire customers is climbing. Data shows that from 2013 to 2021, Customer Acquisition Cost (CAC) surged by a staggering 222%.

However, the smart use of AI in marketing for better targeting and personalization has been shown to potentially slash CAC by up to 50%. By blending smarter paid strategies with organic channels like SEO, you can lower your blended CPA and build a much more resilient business.

Still Have Questions About CPA?

Getting comfortable with acquisition metrics takes a minute, and a few common questions always pop up. Let's clear the air so you can start calculating your cost per acquisition with confidence.

A big point of confusion for marketers is the difference between CPA (Cost Per Acquisition) and CAC (Customer Acquisition Cost). They sound similar, but they tell very different stories.

Think of CPA as a campaign-specific metric. It's the cost to get one specific action, like a lead, a free trial sign-up, or a single sale from a particular ad. In contrast, CAC is a much broader business metric. It bundles all your marketing and sales costs—salaries, software, ad spend, everything—to figure out the total cost to land one brand new, paying customer.

How Often Should I Calculate CPA?

Honestly, it depends on the pace of your campaign. For something fast and furious like a TikTok or Google Ads campaign, you should be checking your CPA weekly, maybe even daily. This lets you make quick adjustments before you burn through your budget.

For longer-term plays like an influencer marketing program or content marketing, a monthly or quarterly calculation makes more sense. It gives you a more strategic view of how things are trending over time.

The real magic isn't just in calculating CPA, but in doing it consistently for every single channel. That's how you spot your most efficient marketing efforts and know exactly where to shift your budget for the best possible ROI.

And yes, you absolutely need different CPAs for different channels. Lumping them all together is a huge mistake. The only way to truly know what's working is to calculate it separately for your influencer outreach, your Meta ads, and your email marketing. This channel-specific insight is what turns CPA from a simple number into a powerful tool for profitable growth.

Ready to connect with a diverse network of over 250,000 creators and start lowering your CPA? JoinBrands makes it incredibly simple to find TikTok Shop Affiliates, UGC producers, and influencers who drive real results. You can manage your entire campaign workflow, from matching to content approval, all in one place. Start your next high-impact campaign with JoinBrands today.