Granny Spills: The AI Grandma Who Went Viral… But Can’t Sell Your Product

Granny Spills: The AI Grandma Who Went Viral… But Can’t Sell Your Product

In 2025, influencer marketing is thriving. According to Global Newswire reporting, the market is projected to reach $163.8 billion by 2030. This figure means great opportunities for brands and influencers, but it also implies a significant change in influencer marketing platforms and brand-creator partnerships. More and more big platforms are taking over small niche companies to offer more comprehensive and one-stop-shop solutions.

For companies and marketing teams evaluating their final options for influencer marketing partners, understanding these industry changes is critical. Every merger or acquisition shifts the influencer marketing landscape, affecting platform features, pricing, campaign management, and overall returns. At this stage in your decision-making process, understanding how industry consolidation impacts every part of an influencer campaign can spell the difference between major successes or lost chances.

Table of Contents

Key drivers that fuel the surge for influencer marketing M&A

High-profile acquisitions, from major advertising agencies acquiring influencer platforms to consumer giants purchasing creator-led brands, signal a race to secure tools, talents, and technology before the competition. Private capital is less predictable—which is why many small influencer marketing platforms and startups explore buyouts to ensure growth and survival.

Several factors fuel the ongoing wave of influencer marketing M&As:

Proven business model

Major advertising agencies, such as Publicis Groupe, view influencer marketing as essential. Their recent half-billion-dollar Influential acquisition underscores the growing importance of gaining direct access to digital audiences. Chris Erwin, founder of M&A advisory firm Rockwell Industries, noted in this Business Insider report that these large players see influencers as the new gatekeepers of digital audiences, and brands want direct access.

Pent-up demand for growth

Turbulent private capital markets combined with platforms’ need for constant expansion have created what industry experts call inherent pent-up acquisition demand. Many businesses would rather join forces instead of risking a lack of progress or facing competition on their own.

Strong industry valuations

Analysts from Goldman Sachs, a multinational financial services company, identified influencer marketing spending as a primary growth driver in the broader creator economy. That level of financial optimism often encourages bigger companies to pursue buyouts of smaller, specialized, or niched platforms.

Cross-border expansion

Non-US companies are making big and bold moves to scale up their global creator operations. This includes buying established influencer tools and services so they can efficiently and quickly enter new markets without reinventing the wheel.

Recent mergers and acquisitions to watch

- Later acquires Mavely (January 2025)

- Acquisition amount: $250 million

Later is a social media management and influencer marketing platform based in Canada, while Mavely connects brands with everyday creators. With its recent acquisition, Later was given access to a network of more than 120,000 creators. These creators have played a key role in helping brands like Nike and Lululemon make over $1 billion in sales.

By merging Later’s established technology with Mavely’s affiliate-driven capabilities, brands have the opportunity to tap into ROAS-based campaigns, granular performance data, and deeper insights into revenue-generating partnerships. Creators can benefit from expanded monetization and real-time analytics to help them grow their brands.

- Ducedo Group acquires Node App (September 2024)

- Acquisition amount: $13 million

Dulcedo Group, a top talent management agency from Montreal, acquired Node App, a platform for influencer marketing and product gifting. Node’s AI-driven platform matches micro-influencers with brands, helping them launch campaigns easily and track engagement on a large scale. This acquisition combines Dulcedo’s pool of influencers and collective reach of 300 million followers with Node’s technology. Through the acquisition, Dulcedo aims to provide smart, data-driven solutions for clients worldwide.

- Hoozu acquires 26 Talent (July 2024)

- Acquisition amount: Undisclosed

Hoozu strengthened its position in the Asia-Pacific region with its acquisition of 26 Talent, an Australian agency known for its work with top-tier influencers. Under this arrangement, 26 Talent’s services merged into Huume, Hoozu’s talent management division led by 26 Talent’s founder. The move expands Hoozu’s reach to offer a broader range of creators and more sophisticated marketing strategies to brands looking for high-impact campaigns.

Hoozu is no stranger to M&A. In December 2023, the influencer marketing company was acquired by IZEA Worldwide to extend the latter’s footprint into Oceania. Before the acquisition, Hoozu handled leading regional brands like Super Cheap Auto and Bunnings. Huume’s integration with IZEA’s existing platform expands data capabilities and client services across the APAC region.

- Collective Artists Network acquires Galleri5 (July 2024)

- Acquisition amount: Undisclosed

India’s Collective Artists Network acquired Galleri5, an influencer marketing and content management platform powered by AI. This move expands the agency’s growing collection, which already includes Terribly Tiny Tales and Under 25 Universe. Galleri5’s technology-driven approach offers better targeting, trend identification, and personalized storytelling for Collective’s talent and brand partners. After nearly ten years of innovating in influencer campaigns, Galleri5 now has a stronger base to enhance its AI and data solutions.

- Publicis Groupe acquires Influential (July 2024)

- Acquisition amount: $500 million

Publicis Groupe, a global advertising company, made a bold move with this impressive deal. Influential engages with 3.5 million creators and uses advanced technology, establishing a strong presence in both the influencer and advertising world. Integrating Influential’s tools with Publicis-owned Epsilon, the new entity offers advanced consumer insights, better cross-channel measurement, and a premium creator marketplace. Publicis Groupe has experienced a positive shift in its market presence and growth, reporting a 5.8% increase in organic growth for Q3 2024, in part due to this acquisition.

- Stagwell acquires LEADERS (July 2024)

- Acquisition amount: Undisclosed

Forward-thinking marketing network, Stagwell, acquired Tel-Aviv-based LEADERS and its influencer marketing AI (IMAI) SaaS platform. LEADERS is a leading influencer marketing and social commerce in the region while IMAI connects brands with more than 300 million creators worldwide. The acquisition fits snugly into Stagwell’s strategy of merging advanced AI tools with high-grade marketing know-how.

- Ykone acquires Barcode (March 2024)

- Acquisition amount: 70% stake valued at $18 to $20 million

French influencer marketing firm, Ykone, acquired the majority stake in the Indian-based influencer platform, Barcode. This strategic move provides Ykone a solid foothold in India’s burgeoning market where luxury brands and social media usage are on the rise. Barcode’s talent department, Click Media, manages high-profile Indian actors and influencers, which furthers Ykone’s global creator network. Ykone plans to optimize Barcode’s local expertise while extending innovative social media solutions to global clients.

- Boksi acquires the influencer GmbH (February 2024)

- Acquisition amount: Undisclosed

Finnish platform, Boksi.com, expands its Central European presence with its purchase of the influencer GmbH, a German agency that has worked with Volkswagen and the European Commission. This move gives Boksi immediate access to a network of German creators and reshapes its footing in the country’s evolving influencer space. The influencer GmbH will keep its brand identity while merging Boksi.com’s advanced campaign management software for faster and more in-depth operations.

How M&As impact brands and creators

M&As come with unique advantages and challenges. Here’s how they affect brands and creators:

Positive impacts on brands

- In-depth audience insights through combined data: As the adage goes, “Two heads are better than one.” When two influencer networks merge, the newly formed entity often inherits richer and broader user engagement data. Brands can then refine their targeting based on cross-platform demographics and behavioral analytics to help launch winning UGC campaigns.

- Economies of scale for creative partnerships: Larger, merged influencer networks can distribute production costs and marketing resources across multiple creators, cutting overhead. As such, brands can develop and execute higher-quality campaigns, such as multi-channel video series, without stretching their budgets too thin.

- Opportunity for niche vertical market penetration: If a brand focusing on eco-friendly products and services merges with an influencer network specializing in travel, it gains instant credibility. By testing a pilot campaign on a newly consolidated platform with strong travel-focused influencers, the brand can send sample products on a trip and document their value in real-life settings. This cross-niche marketing strategy introduces the brand to a new audience segment and highlights the authenticity of the product’s sustainable features.

Potential challenges

- Over-reliance on a single mega platform. When an acquisition leads to one dominant player, brands risk putting all their influencer relations under one roof. If the merged platform’s policies or fees changed, it could hinder the brand’s flexibility and negotiating power.

- Integration fatigue. An acquisition brings new and exciting features. While these shiny gears are fun during test runs, actual integrations on multiple influencer teams and tools can be overwhelming and disrupt current workflows.

ALT TXT: Female content creator filming

Positive impacts on creators

- Integration access to shared ecosystems. When platforms join forces, creators gain access to new and advanced tech stacks. These resources can help smaller creators produce more polished content and monitor their campaigns with professional-grade tools.

- Partnerships with cross-niche creators. Merged platforms can connect culinary influencers with hobbyists or beauty creators with pop-culture reactors, cultivating unique and creative partnerships. This cross-pollination introduces creators to new followers and sparks new content ideas.

- More stable and long-term contracts. Consolidated agencies tend to offer multi-campaign contracts to top-performing creators, which means more consistent income. Creators benefit from having a predictable revenue stream, giving them the freedom to focus on rolling out quality content rather than constant gig-hunting.

Potential challenges

- Pressure to conform to broader brand guidelines. The dominant agency sometimes uses standardized sponsorship terms, tone, and brand guidelines across its network. Creators with strong, niche voices may feel pressured to change their tone or style to align with the new guidelines, risking their authenticity.

- Limited visibility in a bigger creator pool. The bigger the roster, the harder it is to stand out, especially for nano or micro-influencers. When every category is crowded, newer creators could struggle to secure premium brand deals or high-visibility opportunities.

Why JoinBrands is the solution you need

M&As in influencer marketing reshape the landscape, and some platforms may feel distant or complex to navigate. This is particularly true for smaller brands and emerging creators. JoinBrands provides the solution to this by offering a streamlined experience rooted in transparency, simplicity, and speed.

For brands:

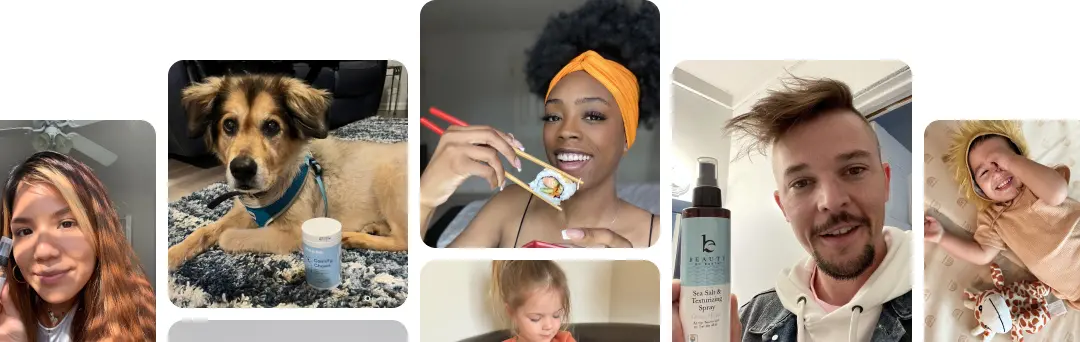

- Immediate access to a diverse roster of UGC creators for brands and agencies

- Customized matchmaking to ensure content aligns with your brand identity

- Seamless campaign management to keep everything simple and effective

For creators:

- Reliable access to paid partnerships that fit your niche

- Tools and resources to help you grow and monetize your creative work

In a rapidly consolidating industry, JoinBrands keeps things straightforward and impactful. Our platform is designed for genuine brand-creator connections, helping both sides achieve tangible results.

Partner with JoinBrands today

The influencer marketing landscape is evolving faster than ever. To stay competitive and secure authentic brand partnerships, you need a platform that understands your needs. Let JoinBrands be your trusted ally in this dynamic space. Book a demo today and see how JoinBrands can transform your marketing efforts.